Getting a new roof? Make it solar.

It’s clear to see that there’s no better time to go solar than when you’re getting a new roof. And, make that new roof work for you! With the DecoTech Solar System installed by a GAF Master Elite or Certified roofing contractor it’s easy to upgrade and start saving money on energy bills. Clean energy is the new paradigm. Choosing solar for your home means contributing to the acceleration of renewable energy use. And that’s a great thing, for now and for generations to come.

The solar pays for the roof

GAF Energy solar can produce electricity at a lower cost than your utility company. The more you produce and use your own electricity, the less you purchase from the utility company. Over time, GAF Energy solar can even pay for itself AND your new roof via monthly electric bill savings and government incentives. You can also get credit for solar energy you send back to the grid when your panels produce more power than your home uses. This further increases your monthly savings.

Power and precision

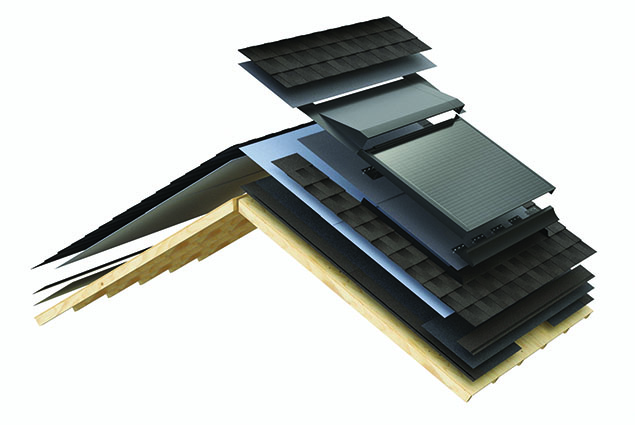

GAF Energy solar panels are designed to be direct-to-deck, roof integrated without racks or exposed wires. Unlike rack-mounted panels, the DecoTech® System features perimeter protection with counterflashing and step flashing that all but eliminates the risks of leaks and infiltration by debris and animals. The sleek, beautiful, low profile affordable panels enhance the curb appeal of your home. This is a roof the neighbors will envy.

We’ve got you covered

The GAF Energy system makes it easy for you to go solar. Your new roof and its integrated solar have the option to be covered under the same industry leading warranty. The limited warranty coverage for manufacturing defects for the solar system is 25 years if you purchase the Golden Pledge Warranty and 10 years for the Smart Choice Protection Warranty These warranties are backed by our partnership with GAF, a company that has been in business for more than 100 years.

Visit GAF for more information: https://www.gaf.energy/about/